Jump to

How You Can Help

Gifts of Life Insurance

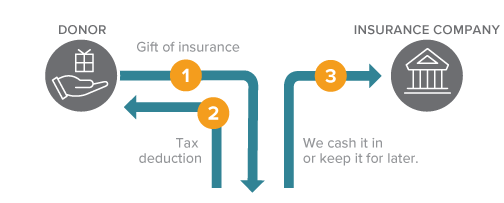

How It Works

- You transfer ownership of a paid-up life insurance policy to The White House Historical Association.

- WHHA elects to cash in the policy now or hold it.

- Consider naming WHHA in your long-term plans. It's simple.

Benefits

- Make a gift using an asset that you and your family no longer need.

- Receive an income tax deduction equal to the cash surrender value of the policy.

- You may be able to use the cash value of your policy to fund a gift that delivers income, such as a deferred gift annuity.

Next

- More details on gifts of life insurance.

- Frequently asked questions on gifts of life insurance.

- Contact us so we can assist you through every step.

Contact Us

Planning your estate and legacy for future generations, including your charitable interests, takes careful evaluation. Consulting with the appropriate professionals can assist you.

legacygiving@whha.org

(202) 218-4329

(202) 218-4329